January - March 2024 • Spend Management

Unlocking Value in Every Swipe, a pioneering debit card rewards program

Opportunity

Arc faces the challenge of increasing debit card usage in a market where charge and credit cards (i.e. AMEX Platinum) typically offer more attractive benefits. Our objective is to innovatively incentivize Arc debit card use, retaining customers who might otherwise turn to competitors like Mercury or Brex. This strategy aims to boost transaction volumes and operating account utilization, directly impacting Arc's revenue generation.

solution

That's why we're introducing Arc Rewards — a pioneering rewards program tailored specifically for debit card users. With Arc Rewards, every purchase earns points, creating a direct path to cash back, bill payments, gift cards, or even future travel rewards. This program is designed to encourage users to channel more of their spending through their Arc debit card, thereby boosting transaction volumes and enhancing the utilization of operating accounts. But we don't stop there. Arc Rewards also accrues points on idle cash in Business accounts, incentivizing higher deposits.

For customers seeking even greater value, a monthly SAAS fee of $500 unlocks Platinum status, offering triple points on select categories and additional exclusive benefits on the platform. This not only elevates the user experience but also opens a new revenue stream for Arc.

5M+

points

Reward points redeemed since launching

82%

increase

Increase in debit card usage volume across all customers

$1.4M+

increase

In total cash stored in Business account across all customers

The Catalyst for a Rewards program

While debit cards are a cornerstone of banking, they often lack the compelling rewards and incentives that drive increased usage, leaving a significant gap in both customer satisfaction, loyalty and revenue potential.

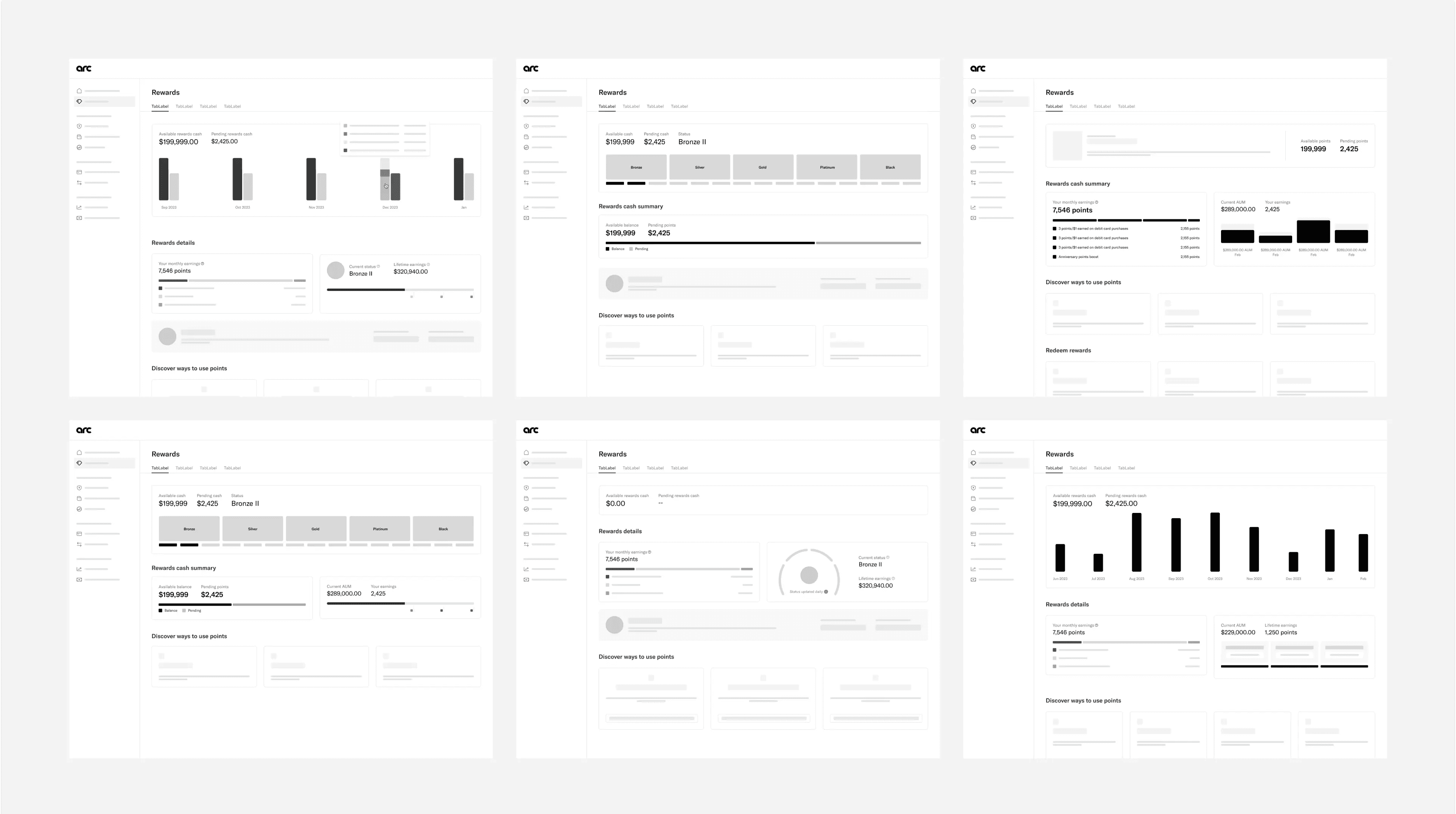

exploring Interface ideas

Given that we were venturing into uncharted territory, our exploration phase was crucial and wide-ranging. I collaborated extensively with the team, generating numerous ideas through sketches and brainstorming sessions. I developed low-fidelity wireframes and prototypes for testing, with a particular focus on gamification strategies to enhance engagement. This intensive process culminated in four key paradigms: point-earning visualizations, product upsell bonus banners, point-based leveling badges, and strategic placement of redemption entry points.

All-new check deposit rail

Arc users can now deposit checks instantly by uploading images directly to Arc. Our system verifies and confirms checks in real-time, reducing the processing time and streamlining the deposit process.

All-new check deposit rail

Arc users can now deposit checks instantly by uploading images directly to Arc. Our system verifies and confirms checks in real-time, reducing the processing time and streamlining the deposit process.

Redeem cashback

Arc users can now deposit checks instantly by uploading images directly to Arc. Our system verifies and confirms checks in real-time, reducing the processing time and streamlining the deposit process.

outcomes

I experienced the intricacies that come with navigating a project of this size and scope, as well as seeing the evolution of a small-experiment-turned-successful-feature. I learned how to be a more effective communicator, collaborator, and facilitator, and how every great product update starts with a humble ambition to improve the status quo. I’m proud to have had a hand in raising the bar alongside a world-class team.

We launched Arc Bill Pay in June of 2024 and it has been incredibly well received. Here are some kind words from our valuable customers.

Credits

It’s a huge privilege to have ownership over such a critical project and while I’m extremely proud of my role, it takes an entire village to get us across the line. Massive thanks to my key collaborators and many others.

Christopher Sim

Design Lead

Elliot Bensabat

Product Lead

Aniket Joshi

Engineering Lead

Avi Khemani

Engineer